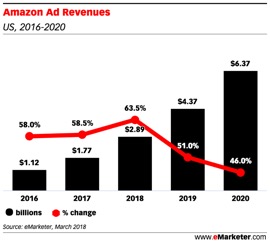

If you’ve been paying attention to Amazon lately, then it’s very likely you saw the following Bloomberg headline, “Amazon Tests Ad Tool That Rivals Google, Criteo“. It sent shockwaves across the industry as it is becoming increasingly clear that advertising and marketing is now more and more important to Amazon. There are many that applaud Amazon’s efforts to take on the duopoly of Google and Facebook as businesses look to lessen their dependence on the two. With revenues projected to be greater than $6B by 2020, it certainly seems that Amazon’s value prop as an advertising/marketing platform resonates with the market.

Great story right? What’s not to love?

Well, if you happen to compete with Amazon in any meaningful way, the growth of their ad business and other non-ecommerce revenue streams should set off warning bells.

In Q1 of this year, Amazon reported profits of $1.6B—which was more than 2X their profits in the same timeframe the prior year. Amazon has always been a revenue growth engine but profits had always eluded them (this of course, by design) due to the low margin nature of their ecommerce business. Amazon has always sacrificed profits for growth and market share, however the tides are clearly turning and Amazon is now showing explosive revenue AND profit growth. The increases in profits can clearly be attributed to Amazon’s increased investment in their AWS and Ad business lines. This gives Amazon an unfair margin advantage relative to their competitors as they can essentially subsidize business lines, products or entire categories in which they want to dominate.

In addition to this massive advantage they have other tricks up their sleeve. As professor Scott Galloway states in The Atlantic’s new podcast “Crazy/Genius“, Amazon can pull a “Jedi Mind Trick”, meaning with a single press release they can drop a competitors market cap 30%, single handedly making it harder for their competitors to access capital. Walmart, Kroger, Target, Costco and others lost nearly $22B in enterprise value after the Amazon/Whole Foods merger announcement. The combination of Amazon’s non-ecommerce business lines and their access to cheap capital make them a nightmare of a competitor.

While not every business might have the ability to build additional business lines from the ground up, the good news is there are many different ways to deliver diversified revenue streams to supplement and enhance your core business. Brands like CVS, Kohl’s, Walmart, Target, and Best Buy all have media businesses that help them capture revenue from supplier partners as well as advertisers looking for specific audiences. The revenue generated from these programs can be used to reduce the pressure of lower margins due to price cuts or to test and incubate new and innovative product lines/services that aim to delight customers.

Is advertising revenue the definitive answer for how brands are going to compete with Amazon? No, I don’t think that’s realistic. But a well thought out ad business which incorporates partners, suppliers and respected brands can not only add value to the customer experience, but deliver revenue to the bottom line which over time can be leveraged to improve your core business.

The post Amazon Is Coming To Eat Your Lunch! appeared first on LiveIntent Blog.